Massachusetts AG refuses to disclose details of gun law interpretation process

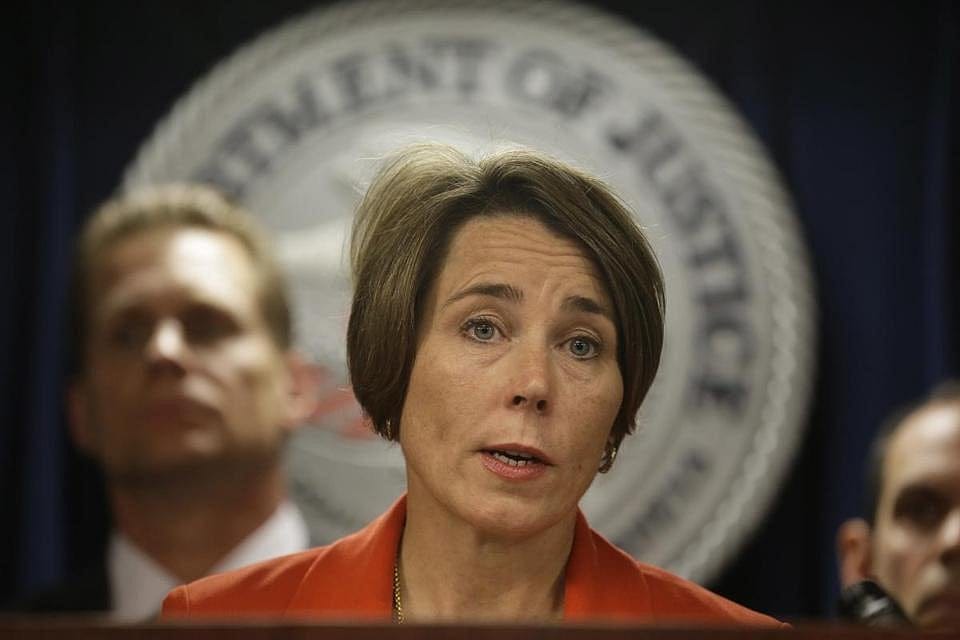

BOSTON — A month after Attorney General Maura Healey caught gun owners by surprise with a new interpretation of state firearms laws, citing the prevalence of what she described as illegal "copycat" assault weapons, questions remain as to how she arrived at the decision and whether Gov. Baker knew of the plan in advance.

Holden resident David Reinhart wanted to know more, so he filed a Freedom of Information Act request with Healey's office, asking for documents he believed would show how Healey came to her conclusion.